5 Proven Tips for Generating Financial Advisor Leads With HelloBar

I hope you enjoy this blog post. If you want Hello Bar to grow your leads, click here.

Author:

Ryan Bettencourt

Published

July 30, 2021

Lead generation is a hurdle many businesses have to deal with every day — and the financial advisory business is no exception.

In fact, according to Melissa Horton, a veteran in the financial services and planning industry, aside from high stress and the ongoing need to comply with regulations, among the drawbacks of financial advisory are the time and energy necessary to build a client base.

Good, old-school word of mouth reflects the value you provide to happy clients, but relying on it alone is not sustainable.

To build a healthy, steady stream of income, financial advisor leads have to continually enter your sales pipeline.

This means complementing word of mouth with other lead generation strategies.

How to Grow Your Client Base as a Financial Advisor

If you’re new to the game and still wondering how to get your first client as a financial advisor, here are five ways to generate leads with HelloBar.

1. Create a website.

In 2017, a CNBC study found that approximately 45% of small businesses don’t have a website, primarily due to people’s fear of technology.

In 2021, that fear appears to have waned. Survey data from Top Design Firms found that 71% of small businesses in the U.S. already have a website.

However, that still means more than one in four small businesses are operating without an online presence.

In the age of the internet (and now more than ever with COVID-19), if your prospective clients can’t find you online, they are likely to think you don’t exist.

Building a website is cheaper and easier today than it was years ago.

You can hire a professional or do it yourself, depending on your budget, availability, and skills.

Your website shouldn’t just be a place where you publish your contact details or the menu of services you offer.

Instead, maximize the full potential of this vital piece of real estate by integrating marketing tools for financial advisors that you can use to automate lead capture and data analysis, among others.

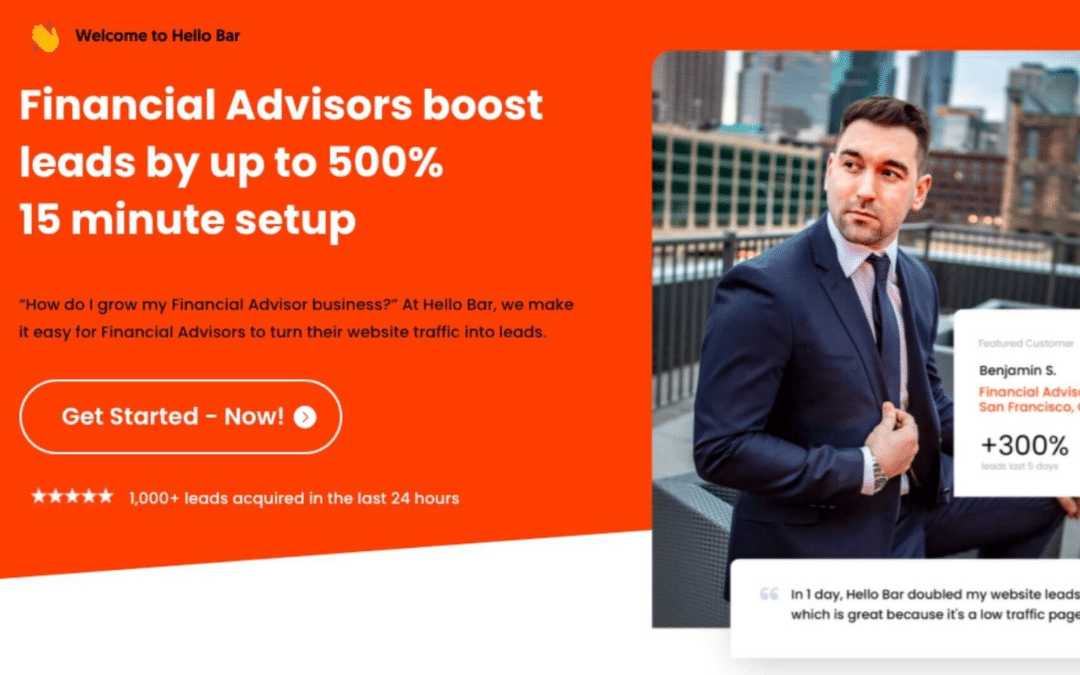

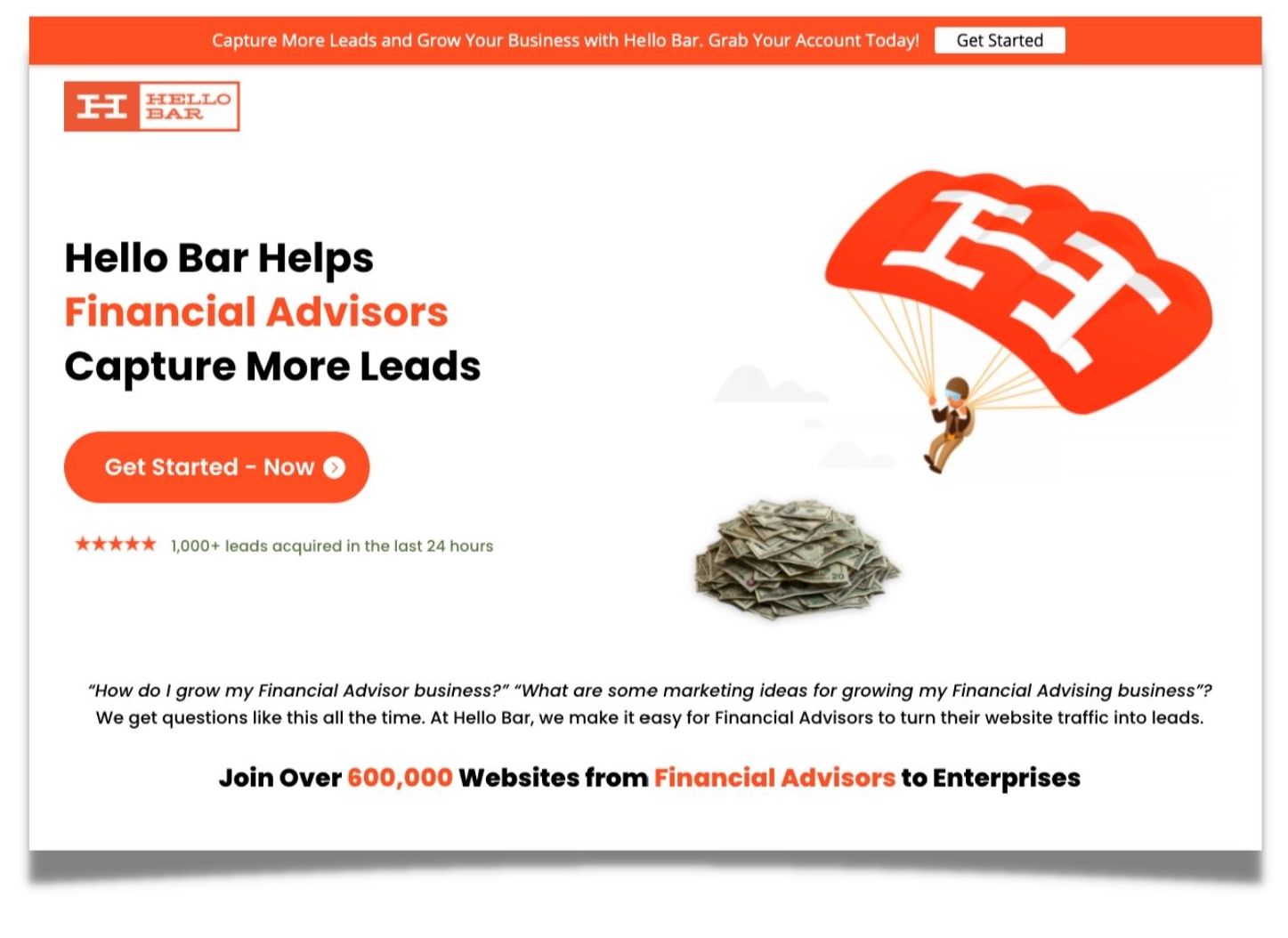

HelloBar, for instance, allows you to show relevant, targeted, and well-timed messages for your website’s visitors.

Do you want to update them on the latest industry news, the available dates and time in your calendar for free consultation, or a webinar you’re hosting on financial planning?

HelloBar can take care of all that for you.

A HelloBar announcement can look like this:

2. Publish a blog.

You go to a doctor when you’re sick because they’re the experts on how the human body works.

In the same way, people looking for personal finance or investment advice will want to deal with professionals who know what they’re doing.

Or they risk their bottom line suffering a hit. According to data from Statista, as of January 2021, there were about 4.66 billion active internet users around the world.

If you factor in the fact that 60% read blogs, you can probably understand why blogging is a critical addition to your arsenal of investment advisor tools.

Done right, blogging establishes your reputation as an expert in the field.

If you’re an equipment finance advisor, for example, you can blog about equipment leasing or how to purchase equipment with a loan.

If you provide consulting or marketing services for financial advisors, topics you can write about include:

- How do financial advisors get clients?

- How do you get certified as a financial planner?

- What are some of the most creative marketing ideas for financial advisors?

- How do you qualify prospective types of clients for financial advisors?

- What rules and regulations should investment advisors know about?

- Does cold calling for financial advisors really work?

- How do you become a top financial advisor?

- How do you get clients as a financial advisor during COVID-19?

Readers want informative and insightful content to educate them on the topics they’re interested in.

With HelloBar, you can automatically recommend other blog posts visitors may be looking for, such as popular and recent posts.

3. Build an email list.

An email list is a collection of all the email addresses you’ve gathered via your website or blog.

But how exactly can it help you with prospecting for financial advisors?

According to research firm Radicati, by the end of 2021, the total number of business and consumer emails users will send and receive per day will exceed 319 billion.

By 2025, that number is expected to increase to 376 billion.

In other words, email is still one of the most widely used forms of communication around the world.

As long as you follow email marketing best practices (e.g., send emails that resonate, segment your lists, avoid spammy headlines, etc.), recipients are likely to open your messages.

Website visitors, however, don’t give out their email address to just about any site that asks for it.

There has to be a reason to trust you with it. One way is to offer lead magnets, which are services or items given away for free in exchange for visitors’ contact details.

For financial advisors, lead magnets can come in any of the following forms:

- Budgeting guide

- Questionnaire or quiz that assesses risk tolerance

- A list of questions to ask a financial advisor on the first meeting

- Personal net worth or retirement savings calculator

- Analyst reports on the best retirement investments

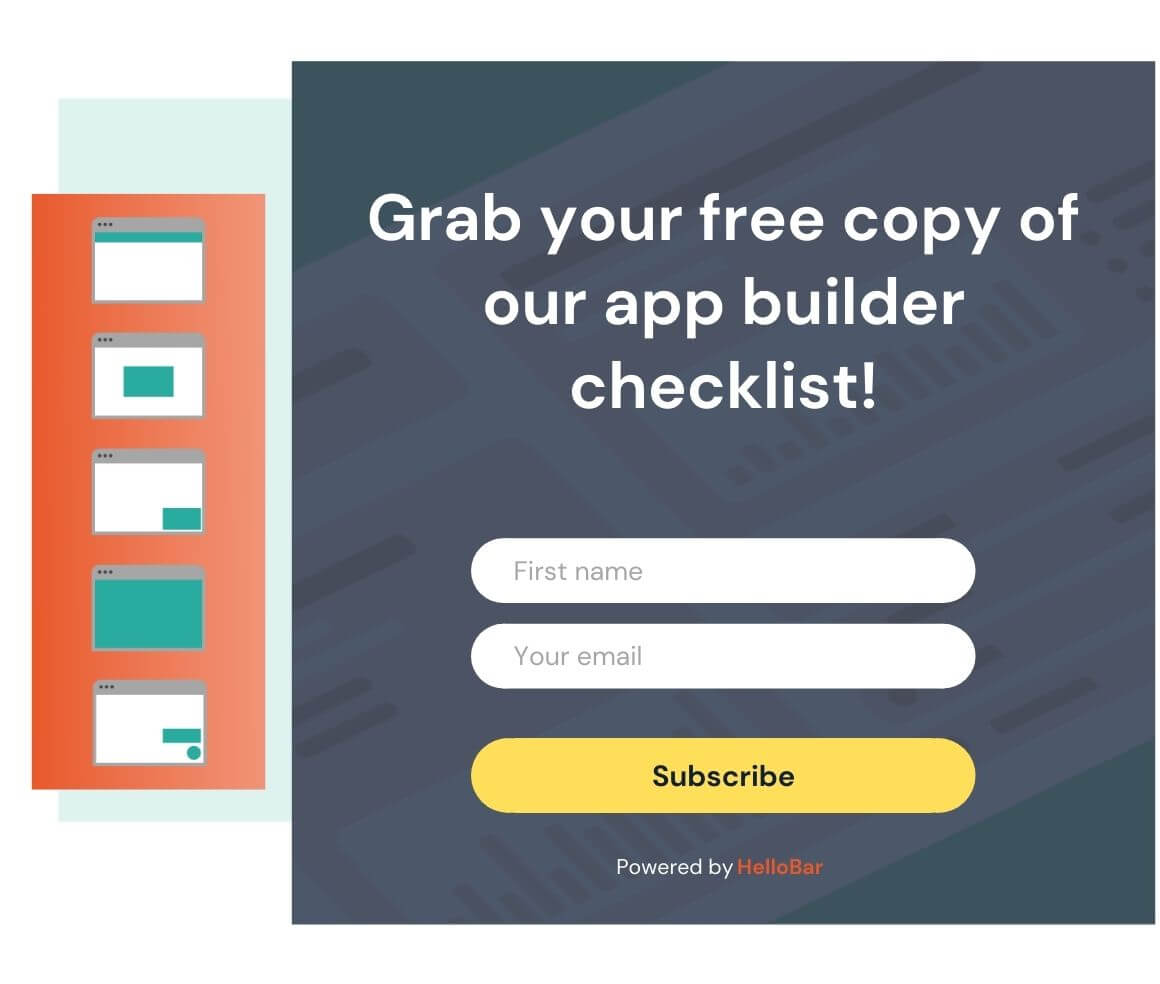

With HelloBar, you can collect email addresses (and send the lead magnet content to your subscribers) using several different designs and styles: top bar, exit popup, slider, or page takeover.

Run tests to see which works for you and your audience.

You don’t always need a lead magnet to entice readers to subscribe to your mailing list, though.

If your content is good, updates on when a new blog post or whitepaper is published is enough to get them to join.

Here’s an example of a lead capture form using HelloBar:  Looking to capture leads? Grab your account today

Looking to capture leads? Grab your account today

4. Leverage the power of social media.

3.6 billion — that’s the number of social media users in 2020.

By 2025, that number is projected to jump to 4.41 billion.

This only means that the exclusive financial advisor leads you’re looking for are likely on at least one social media platform.

In another Statista report that ranked social networking sites according to the number of active users, Facebook came out on top with more than 2.79 billion monthly active users as of April 2021.

YouTube placed second with 2.29 billion users, and WhatsApp came in third with 2 billion.

That’s not to suggest that you can forget about the bottom three – Reddit, Twitter, and Quora – because they can also play a pivotal role in the success of your campaigns.

Here’s how to take advantage of the lead generation boost social media can provide:

- Build your brand. Create business pages on Facebook or LinkedIn to establish awareness for your brand and the type of services you provide. Remember, you don’t have to be on every social media platform. Choose only those that make sense for your business.

- Run ads. Aside from social media advertising being way cheaper than traditional advertising, what makes the former so attractive are the insights you generate for each ad you run. You also get to choose your audience and set your budget limit.

- Communicate with your clients. A business page on social media enables your current and prospective clients to communicate directly with you. Perhaps they have a question or concern, or want to learn more about what you offer. They can bring issues to your attention, and you can be more responsive to their needs.

- Increase website exposure. On all your social media pages, provide links to your website’s homepage, blog, landing pages, and other relevant pages. This way, visitors can explore the content of your website at their convenience.

After setting up your social media page, use HelloBar to refer visitors to it.

This technique is particularly useful when promoting a new financial services profile.

5. Network.

“If you’re not constantly networking, you are doing your business a disservice,” says CNBC correspondent and Investopedia journalist Leslie Kramer.

That’s because the financial advice business is rooted in community and relationships. Pre-pandemic, that meant in-person meetings, networking events, conferences, and seminars.

But with the pandemic still ongoing and COVID-wary prospects choosing to stay home except for essential activities, networking has largely gone virtual.

As long as it’s safe and you’re able, particularly if you’re targeting local leads, attending events can help you meet new people and expand your reach.

Once there:

- Deliver a short speech about yourself and your business, the clients you serve, and how you’re helping them.

- Distribute business cards, and, if available, books you authored on investment management or financial planning. Make sure your cards have your website URL. The same goes for your books.

To network virtually:

- Join relevant social media groups. Participate in conversations. Provide helpful content that answers members’ questions to solidify your reputation.

- Expand your social networks by sending personalized connection requests to people you meet.

Make your website URL visible on your profile.

You want more traffic to your website so HelloBar can do what it’s designed to do: convert visitors into clients.

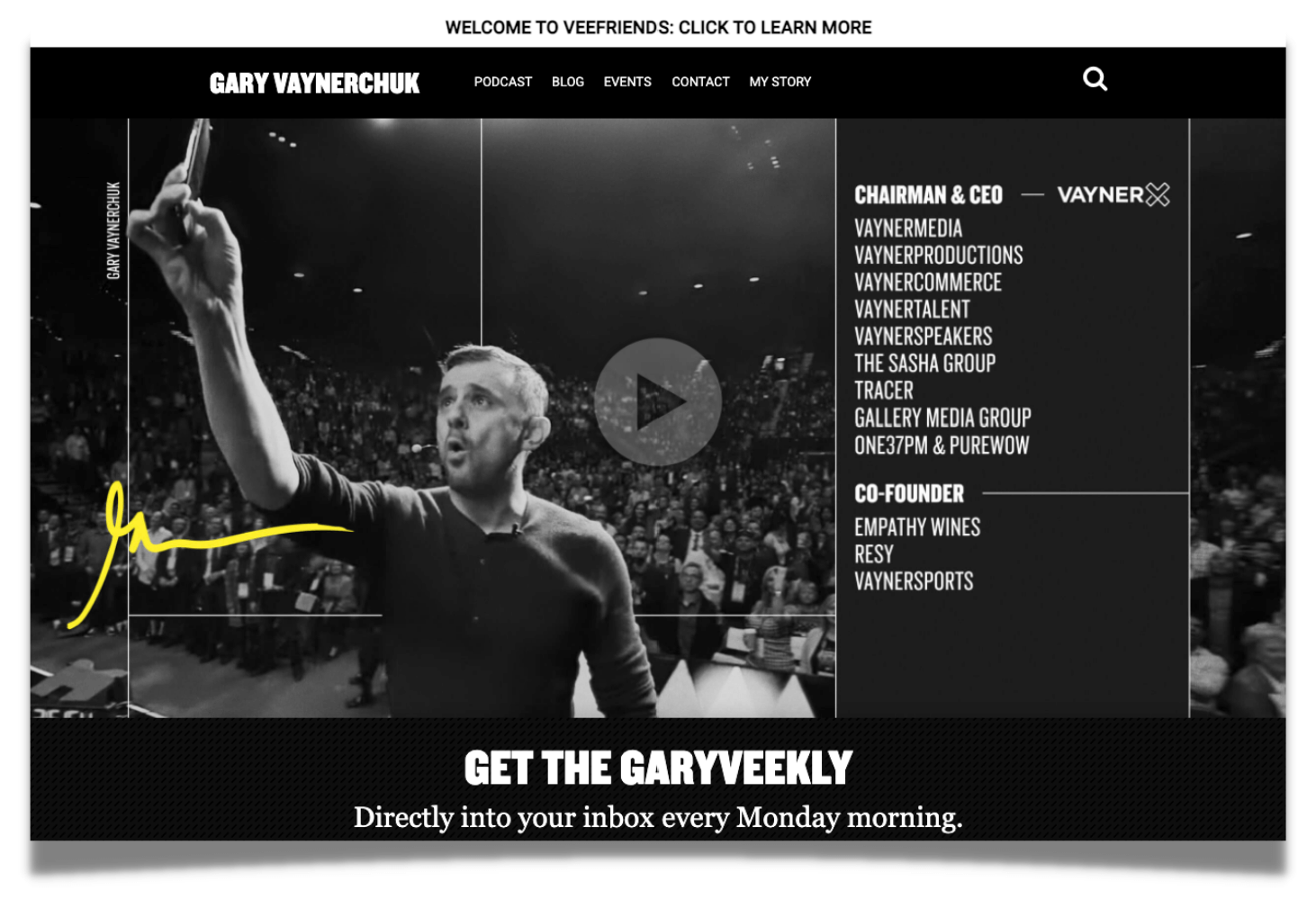

Here’s a HelloBar message that points visitors to another site that may be of interest to them.

Instead of a website, you may also direct them to a landing page where they can access a recording of a conference call you participated in as a resource person, for example.

Source: GaryVaynerchuk.com

Source: GaryVaynerchuk.com

Acquire More Financial Advisor Leads With HelloBar

Lead generation strategies for financial advisors are numerous, but to boost conversion rates with HelloBar, the first step is to get your website up and running.

From there, you can publish thought-leadership blogs, build an email list, direct visitors to your social media content, and provide exclusive offers for leads you meet at physical or virtual networking events.

To see for yourself how HelloBar can benefit your financial advisory business, create an account today.